Table Of Contents

Completing the Claim Form

When completing the claim form for a windscreen replacement, accuracy is crucial. Ensure that all personal details, such as your policy number and contact information, are correctly filled in. Provide a clear description of the incident that led to the damage. If applicable, include any information regarding the type of damage sustained, specifying if it's related to a side window replacement, as insurers may require different details for various components of the vehicle.

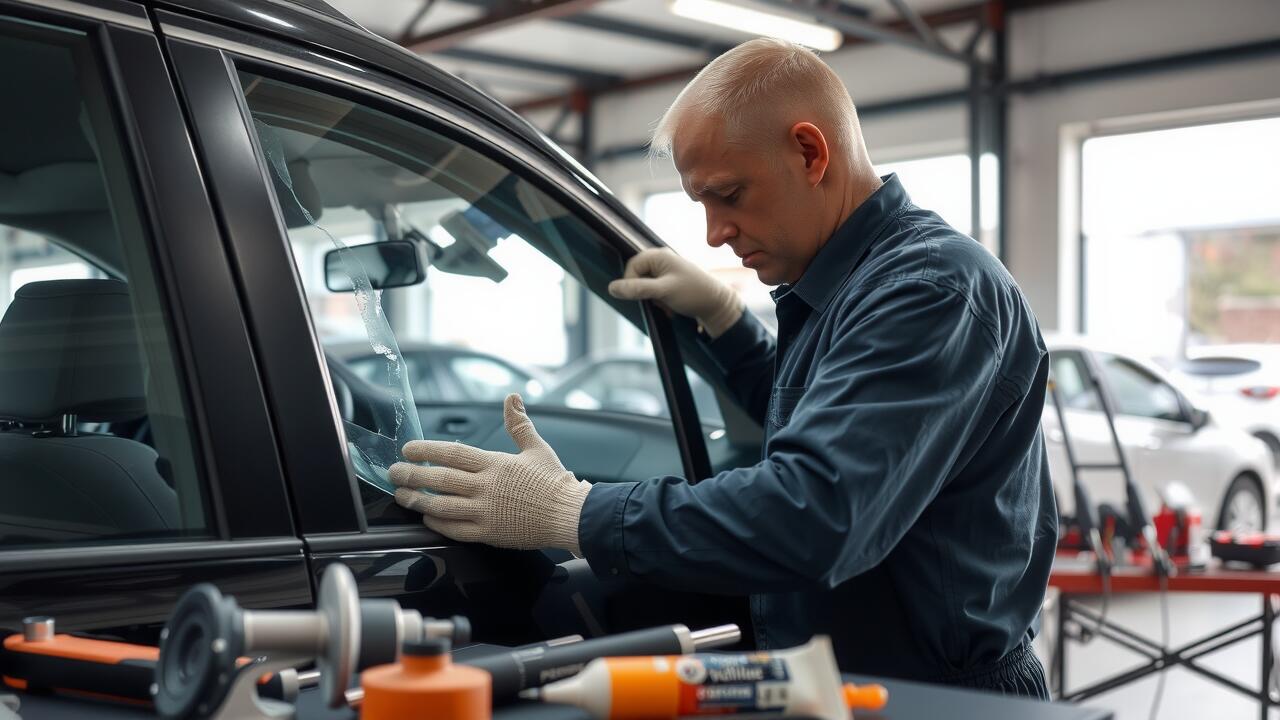

Attach any supporting documentation to your claim form, such as photos of the damage and a copy of the police report if vandalism or theft is involved. Gather quotes from authorised repairers for a side window replacement, as these might be needed to assess the cost of repairs. Submitting complete and clear information will facilitate a smoother claims process.

Key Sections to Focus On When Filling Out the Form

When filling out the claim form for a windscreen replacement, it is essential to pay attention to the key sections that require precise information. Start by detailing the circumstances surrounding the damage. Be sure to include the location of the impact, the extent of the damage, and any relevant weather conditions at the time. Accurate descriptions will help the insurance provider assess the claim effectively. Additionally, provide your policy number and any other identifying details to streamline the process.

Next, include specifics about the type of repair or replacement needed. If the damage involves a side window, ensure you denote this as "Side Window Replacement" in the form. This distinction helps the insurer understand the nature of the claim and whether it qualifies under your policy. Thoroughly reviewing these sections before submission can prevent delays and facilitate quicker processing of your claim.

What Happens After You Submit Your Claim

After submitting your claim, the insurance company will begin the review process to assess the details provided. This involves evaluating the damage reported and confirming that it falls within the scope of your coverage. Depending on the insurer’s protocols, you may receive a communication regarding any additional information they require or steps you need to take for a fast resolution.

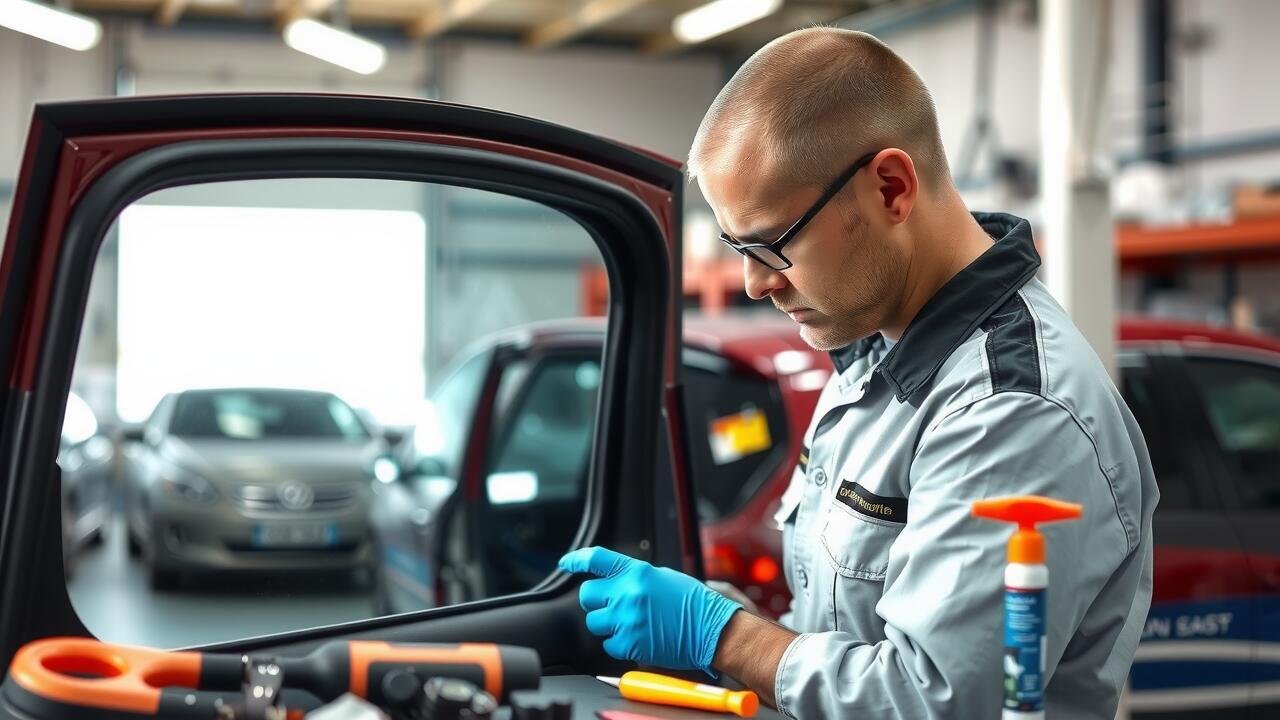

Once the review is complete, the insurer will notify you of their decision. If your claim is approved, they will outline the process for arranging repairs, which may include side window replacement if applicable. It’s essential to pay attention to any instructions regarding repair providers or coverage limits, as this will help you navigate the next steps efficiently.

Understanding the Review Process

Once you submit your windscreen claim, the insurance provider initiates a review process to assess the details and determine eligibility for coverage. This process typically involves verifying that the incident falls within the terms of your policy. They may reach out for additional information or documentation to support your claim. Timeliness is crucial during this phase, as any delays in providing requested details can prolong the review.

After completing their assessment, the insurer will inform you of their decision regarding the claim. If approved, they will outline the next steps for the repair, such as preferred service providers for windscreen repairs or Side Window Replacement. It's important to stay in communication with your insurer during this time, as they can offer guidance on what to expect and how to expedite the repair process if needed.

Potential Costs and Deductibles

When claiming for windscreen damage, it’s essential to understand the potential costs and deductibles involved. Depending on your insurance policy, you may have to pay an excess fee before your insurer covers the remaining expenses. This fee can vary significantly between policies and can sometimes be higher for repairs involving Side Window Replacement compared to standard windscreen repairs. Before proceeding with your claim, check the specifics of your policy to gauge how much you might be liable for.

In some instances, not all damages are covered, especially if the side windows have been broken due to negligence or wear and tear. It's crucial to assess the exact nature of your claim and any cost implications it may have. Even if your insurer covers the repair, you may still need to pay a certain amount out of pocket for costs associated with the Side Window Replacement. This can include service charges or additional fees that are not part of the standard coverage. Having clarity on these potential expenses can help you prepare financially before initiating the claim process.

What You Might Need to Pay Out of Pocket

When you file a claim for windscreen damage, you may encounter certain costs that are your responsibility. Many insurance policies include a deductible, which is the amount you must pay before the insurance coverage kicks in. For example, if your policy has a $500 deductible and your windscreen repair costs $800, you would need to cover the first $500 out of your own pocket. This is especially relevant for glass damage, as repairs or replacements can vary in cost depending on the severity and location of the damage.

Additionally, if your claim extends beyond basic windscreen repair and involves components like Side Window Replacement, the costs can increase significantly. Different insurers may have varying terms for glass claims, so it’s crucial to review your policy and understand any additional charges that could apply for more extensive repairs. It's advisable to get a quote for any potential replacement before proceeding with your claim, ensuring you are well informed about the financial implications.

FAQS

What information do I need to complete the claim form for my windscreen?

You will typically need your policy number, details of the incident, the date and time it occurred, and any relevant photos or documents that support your claim.

How long does it take to process a windscreen claim?

The processing time can vary depending on your insurance provider, but it usually takes a few days to a couple of weeks to review and approve your claim.

Will I have to pay a deductible for my windscreen claim?

It depends on your insurance policy. Some policies may have a specific deductible for windscreen claims, while others may waive the deductible altogether. Always check your policy details.

Can I claim for minor chips or cracks in my windscreen?

Yes, many insurance policies cover minor chips and cracks, often without requiring a deductible. However, it's best to refer to your specific policy for coverage details.

What should I do if my claim is denied?

If your claim is denied, review the reason provided by your insurer. You can contact them for clarification and consider appealing the decision or seeking advice from an insurance ombudsman if necessary.